Yuan outpacing euro Reuters

RT.com

21 Nov 2023, 15:44 GMT+10

Low interest rates have sparked a global rush to borrow in China, the outlet has said

Global companies are reaping record profits through yuan-denominated bonds and are borrowing heavily from Chinese lenders at low interest rates, at a time when the cost of using Western banks is skyrocketing, Reuters reported on Friday.

According to the news agency, international companies and banks are raising record amounts of cash through Chinese 'panda' and 'dim sum' bonds denominated in yuan.

"While the fundamental story is not compelling for Chinese investors looking for growth, the depreciation of the yuan as well as the rate cuts result in a much cheaper cost of borrowing," said Fiona Lim, senior FX strategist at Maybank.

The uptick in China's borrowing market has made the yuan the world's second-biggest trade funding currency, ahead of the euro. The development reflects Beijing's ambitions to boost the yuan's share in global funding, Reuters added.

According to the report, the National Bank of Canada raised 1 billion yuan ($138.6 million) in October from the sale of a three-year panda bond at a coupon of 3.2%, while domestic interest rates stood at 4.5%.

The People's Bank of China (PBOC) has been encouraging banks to lend to international companies and has allowed broader use of the yuan outside the country, the outlet said.

"Panda bonds are steadily promoting the renminbi's function as a funding currency," the PBOC stated in a report last month.

The Chinese yuan showed record gains in September as its share in international payments surged to 5.8%, up from 3.9% at the beginning of the year, outperforming the euro for the first time, data from SWIFT revealed.

The growing share of the yuan in cross-border transactions reflects China's trend of shifting away from the US dollar, as well as Beijing's efforts to promote the use of its national currency.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Philadelphia Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Philadelphia Herald.

More InformationBusiness

SectionBeijing hits back at EU with medical device import curbs

HONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device...

Wall Street reels after Trump invokes new tariffs

NEW YORK, New York - Monday's trading session saw mixed performances across U.S. and global markets, with several major indices posting...

Trump admin allows GE to restart engine sales to China’s COMAC

WASHINGTON, D.C.: The U.S. government has granted GE Aerospace permission to resume jet engine shipments to China's COMAC, a person...

Saudi Aramco plans asset sales to raise billions, say sources

DUBAI, U.A.E.: Saudi Aramco is exploring asset sales as part of a broader push to unlock capital, with gas-fired power plants among...

Russia among 4 systemic risk countries for Italian banks

MILAN, Italy: Italian regulators have flagged four non-EU countries—including Russia—as carrying systemic financial risk for domestic...

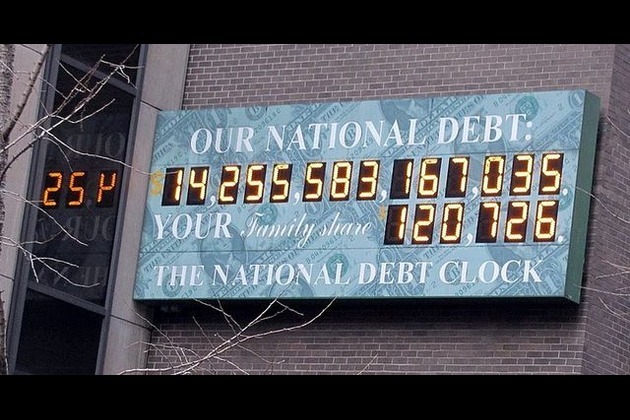

US debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

International

SectionTrump defends use of 'Shylock,' citing ignorance of slur

WASHINGTON, D.C.: President Donald Trump claimed he was unaware that the term shylock is regarded as antisemitic when he used it in...

Summer travel in chaos as French air traffic controllers walk off job

PARIS, France: A strike by French air traffic controllers demanding improved working conditions caused significant disruptions during...

Congress weighs Medicaid cuts, sparking alarm in small-town hospitals

OMAHA, Nebraska: With Congress considering cuts totaling around US$1 trillion to Medicaid over the next decade, concerns are rising...

Gas station blast injures 40 in Rome, kids narrowly escape

ROME, Italy: Quick thinking by emergency responders helped prevent greater devastation after a gas station explosion in southeastern...

Weapons pause by Trump signals shift away from foreign wars

WASHINGTON, D.C.: President Donald Trump is drawing praise from his core supporters after halting key arms shipments to Ukraine, a...

Moscow removes Taliban from banned list, grants official status

MOSCOW, Russia: This week, Russia became the first country to officially recognize the Taliban as the government of Afghanistan since...